Understanding Break Even Analysis

What is Break Even Analysis?

Break even analysis is a financial calculation that helps business owners determine when their company will become profitable. It tells you how many units need to be sold or what level of sales dollars must be achieved to cover total costs—both fixed and variable. When you reach this juncture, known as the break even point, your total revenue equals your total expenses.

How Break Even Analysis Works

To appreciate how break even analysis works, imagine it as a scale balancing revenue and costs. On one side, you have fixed costs such as property taxes, which stay constant regardless of production or sales volume, and variable costs, which fluctuate with the number of units produced or sold. Break even analysis helps you find that perfect balance, ensuring you’re not losing money.

The Importance for New and Existing Businesses

For new businesses, break even analysis is like a flashlight in the darkness, projecting the amount of startup capital needed before turning a net profit. For existing businesses, it’s a magnifying glass that helps catch missing expenses that can cause financial strain.

Calculating Break Even Analysis

The break even point formula is straightforward: divide total fixed costs by the unit contribution margin. The unit contribution margin is the sales price per unit minus the variable cost per unit. This tells you how many units you need to sell to cover total costs.

- Find Your Total Fixed Costs: Rent, salaries, interest paid—these are costs you can’t escape.

- Assess Variable Costs: These costs ebb and flow with your production or sales volume, like raw materials or commission fees.

- Mark the Sales Price per Unit: What will the customer pay for your product?

- Subtract Variable Cost per Unit from Sales Price: This is your unit contribution margin.

- Divide Total Fixed Costs by Unit Contribution Margin: Voila, you’ve got your break even point!

The Three Components of Break Even Analysis

Fixed Costs

This steadfast financial commitment includes rent, staff salaries, and any other expenses that remain stable, regardless of your business’s sales volume.

Variable Costs

From raw materials to production costs, these expenses vary with your sales volume and are crucial to understand in full.

Sales Price

Your pricing strategy must be meticulous. Set prices too high, and you risk slashing market demand. Too low, and you may struggle to cover total costs.

Three Types of Break Even Analysis

By Units

“How many units do I need to sell to break even?” This analysis helps to provide an answer based on fixed costs, variable costs, and the selling price of a single unit.

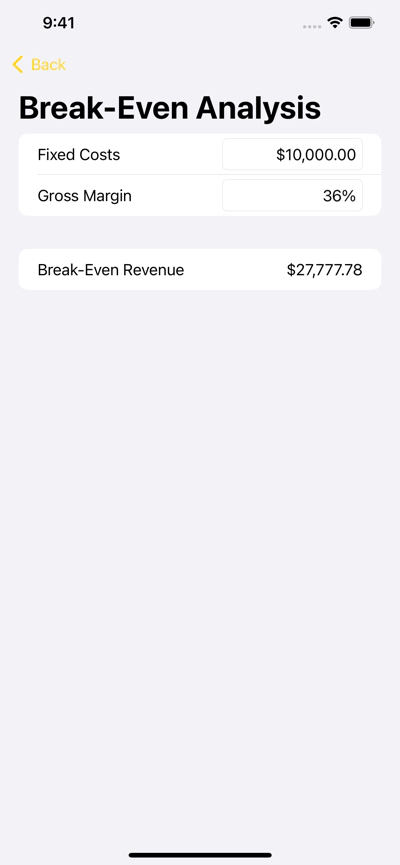

By Sales Dollars

This addresses “How much in sales dollars do I need to achieve to break even?” It’s essentially the dollar amount that equates to selling the number of units at a certain price per unit.

By Time

A time-based break even analysis considers when your business can expect to break even. This requires financial projections and an understanding of your business model and market trends.

Implementing Break Even Analysis in Business Planning

When devising a business plan, incorporating break even analysis can be an eye-opener. Break even analysis tells you how much you need to sell to avoid financial tolls and helps you set solid goals around production costs, pricing strategies, and sales targets.

- Establish Clear Pricing Strategies: Understanding the balance between fixed costs and variable costs helps determine your average selling price and sales strategy.

- Forecast Financial Projections: Break even analysis can give you a clearer picture of future financial health and necessary adjustments.

- Guide Investment Decisions: Knowing when you’ll break even gives confidence to financial institutions and investors about your financial acumen.