The Vital Stats: Demystifying COGS

The Cost of Goods Sold is the siren call for businesses—it represents the direct costs attributing to the production of the goods sold by a company. This figure includes the cost of raw materials, direct labour costs required for production, and any other direct costs involved in getting a product from conception to sale. Simply put, COGS is a key player in the orchestration of your company’s income statement.

Embark on this voyage, and you’ll realize that the COGS affects various business waypoints, notably:

- Gross Profit

- Gross Margin

- Net Income

Calculating COGS can be a complex process, with the need to consider beginning inventory, additional inventory acquisitions, and the remaining inventory at the period’s end. Yet, it’s vital because it offers a clear view of the cost of inventory sold and helps ascertain the gross profit—a critical gauge of a company’s financial health.

Navigating the Seas of Inventory and Costs

Setting sail with Business Calculator +’s Cost of Goods Sold Calculator, businesses have a steadfast ally in their quest for accuracy. The calculator simplifies the voyage by streamlining the process with a few easy steps and number-crunching that renders a manual abacus obsolete.

Starting with the Beginning Inventory

The beginning inventory value is the cash value of all inventory items a company has in stock at the start of the accounting period. This figure is a carry-over from the previous period’s ending inventory. It’s the first wave you’ll ride, setting the stage for the calculations to follow.

Sailing Through Direct Costs

Direct expenses incurred during the production process, such as raw materials and direct labor, along with indirect costs like transportation costs and administrative expenses, form the bulk of the direct costs. Direct costs are essential to producing the goods that a company sells; however, only the direct costs that are attributable to goods sold are factored into the COGS.

Charting the Course of Goods Sold

After maneuvering through beginning inventory and the waters of direct and indirect costs, we reach the critical juncture of calculating the actual cost of the inventory sold during the period. This is where the goods sold calculator becomes an indispensable first mate.

Anchoring Down with Ending Inventory

At the closure of an accounting period, ending inventory must be assessed. This is the value of the unsold stock remaining on board. Ending inventory cost is the final puzzle piece that honors the full circle of the goods sold beginning inventory journey within the defined financial period.

Harnessing the Calculator: A Step-by-Step Guide

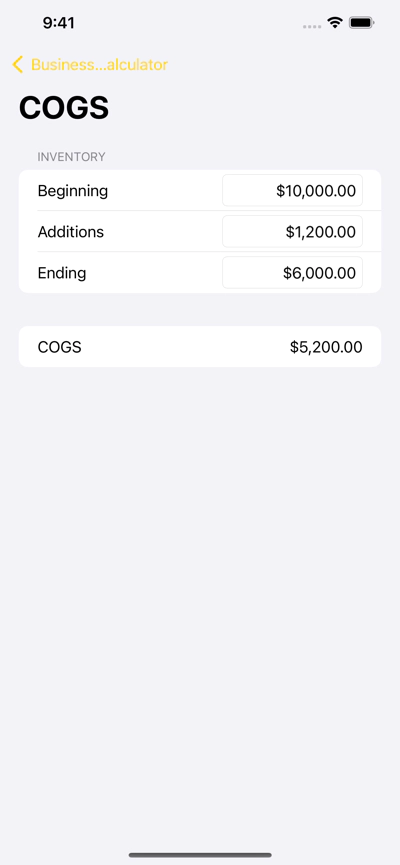

Business Calculator + provides a trusted tool in the form of a Cost of Goods Sold calculator, designed to circumnavigate the often tumultuous task of tallying up COGS. Here’s how you factor in the varying elements to calculate COGS:

- Beginning Inventory Value: This is your starting point—the value of inventory at the beginning of the accounting period.

- Additional Inventory: As the period progresses, any additional inventory that comes aboard falls under inventory costs. All purchases of raw materials,and inventory additions are calculated here.

- Ending Inventory: This is your docking point—the value of inventory that hasn’t left the store by the end of the accounting period.

- The Goods Sold Formula: To finally calculate cost, the COGS formula comes into play: COGS = (Beginning Inventory + Additional Inventory) - Ending Inventory

With just a few inputs—beginning inventory, inventory additions, and ending inventory—the COGS calculator whittles down the process to a matter of seconds. This method frees the crew from manual calculations and potential human error.

Benefits of Utilizing the Cost of Goods Sold Calculator

Implementing this tool into your company’s routine navigates beyond mere number crunching. Some positive latitude and longitude it encompasses include:

- Increased Accuracy: An electronic cogs calculator significantly reduces errors inherent in manual calculations.

- Time Efficiency: Swift and precise, it drastically slashes the time needed for calculations, allowing you to invest efforts elsewhere.

- Informed Price Strategy: Understanding COGS via calculating cogs provides the insight needed to set competitive yet profitable pricing.

- Tax Preparedness: Recognizing taxable income through accurate COGS figures primes a business for correct tax filings.

Charting the Tangible Impacts

Gross Profit and Margins

By accurately calculating COGS, businesses can calculate gross profit and define clear profit margins. Gross profit is found by subtracting COGS from total revenue, while gross profit margin percentage is gross profit divided by total revenue, expressed as a percentage.

Operational Fortitude

Understanding COGS allows businesses to analyse operating expenses and formulate strategies to reduce them. If a business can lower COGS without sacrificing quality, it can increase net profits.

Inventory Management

Accounting for obsolete inventory, maintaining the optimal level of stock, and preventing overstocking are all benefits of precise COGS calculations. Inventory costs are a significant business expense; thus, reducing them can enhance a company’s bottom line.

Financial Statements & Health

The COGS figures feed directly into a company’s financial statements, revealing its financial health. These inspire confidence in stakeholders regarding a company’s ability to manage inventory and generate revenue.