What’s in a Ratio? Knowing Your Debt to Equity

In the world of personal finance and corporate accounting alike, the debt to equity ratio is a potent indicator of a company’s financial leverage. This ratio compares the company’s total liabilities, or debt, to its equity, giving investors and lenders insight into the business’s financial structure and its ability to service debt. A low ratio indicates that a company has not been overly reliant on borrowing, which puts them in good financial health and deemed financially stable. Conversely, a high debt to equity ratio often signifies a company that could be risky to lenders and investors due to its dependence on debt financing.

Decoding the Debt Worth Ratio Calc: Your Guide to Clarity

The debt worth ratio calculator simplifies the complexity of these financial concepts. By entering a few key figures - like current liabilities, long term debt, and your total net worth - the calculator provides an immediate snapshot of your company’s financial well-being. The resulting ratio can influence decisions regarding new loans, future loans, and other financial obligations your business might consider.

The Numbers Game: Total Assets, Liabilities, and Equity

Setting the stage for an informed calculation involves understanding the role of your company’s total assets and liabilities. Assets are everything that the company owns - from cash flow to intangible assets - and they can range from short term assets that are readily converted to cash to long term assets that provide sustained value.

Now let’s look at the other side of the equation - liabilities. These are the monthly payments, credit card debt, loan payments, and even child support that must be met regularly. When calculating debt, consider both short term debt and long term liabilities that encompass credit accounts, utility bills, and other financial obligations. The equity portion of the ratio represents the owner’s stake in the company, being the residual interest after subtracting liabilities from assets.

Using the Calculator: Step by Step

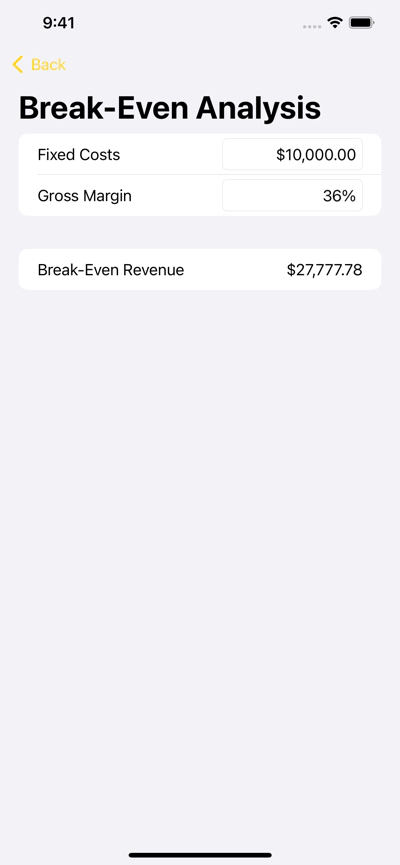

Our debt worth ratio calculator comes with a user-friendly interface that makes it easy to calculate your company’s debt-to-equity position. Here’s how to use it:

- Enter the amount of your company’s debt, specifying each type such as long term debt, monthly debt payments, and other loans.

- Input total owners equity, which is fundamentally the net worth of your company.

- With a single click, the calculator tallies these figures and instantly presents you with your company’s debt ratio and equity ratio.

Beyond the Ratio: Insights into Your Company’s Financial Leverage

Understanding your company’s debt ratio paints a broader picture of financial health and company’s ability to sustain growth, service existing debt, and take on new debt. A high debt to income ratio might indicate your business is over-leveraged, potentially facing higher interest rates on new loans. On the flip side, a company with a low ratio might be missing out on opportunities to expand through strategic debt financing. Remember, not all debt is bad; good debt can be utilized to generate more income or value for the company.

Smart Decisions Moving Forward

The insights you gain from Business Calculator +’s tool will help you make informed decisions concerning your company’s financial future. Whether it’s renegotiating terms with lenders, strategizing to improve cash flow, or making investment decisions, knowing your debt to asset ratio, net worth ratio, and debt to equity is invaluable.