Why Gross Margin Matters

The gross margin is a fundamental metric that represents profit made after subtracting the cost of goods sold (COGS) from total sales revenue. It is illustrated in both dollar value and as a gross margin percentage, providing insights into the portion of sales contributing to covering operating expenses and yielding net profit. Understanding and maintaining a robust gross margin is indicative of a company’s overall efficiency and capability to generate more money with its sales.

The Gross Profit Margin Realms

The gross profit margin is a closer look at the gross margin, indicating the profit a business makes on sales after covering the direct costs associated with producing and selling goods or services. A good profit margin suggests that the company can manage its cost price well and has sound profitability. Meanwhile, the operating profit margin goes one step further by considering operating expenses in the calculation, whereas the net profit margin includes all costs, taxes, and interest, representing profit in relation to net sales.

How the Gross Margin Calculator Works

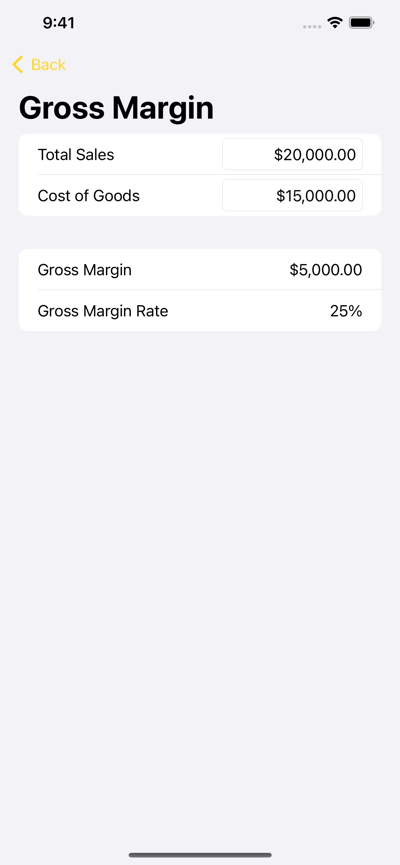

Business Calculator +’s intuitive margin calculator simplifies the task of determining your company’s gross margin. Here is a basic overview:

- Input the total sales revenue.

- Enter the cost of goods sold.

- The calculator will instantly compute the gross margin value and the gross margin percentage.

With this quick measure of profitability, businesses can effectively calculate profit, track the gross profit for various products or services, and fine-tune their price strategies to ensure a higher profit margin.

Leveraging the Profit Margin Calculator

Utilizing our profit margin calculator frequently can lead to insightful trends in your sales margin over time. It assists in evaluating the success of strategies aimed at reducing costs or increasing sales revenue. Whether you’re considering a slight increase to the selling price or scrutinizing your total expenses, the calculator provides precise data for making informed business decisions.

Key Terminologies Simplified

Gross Margin: Money left after COGS are subtracted from net sales.

- Net Profit Margin: Profit after all expenses.

- Operating Profit Margin: Profit after operational costs before interest and taxes.

- Cost of Goods Sold: Direct costs of producing the goods sold.

- Sales Revenue: The total amount of money from sales of goods and services.

Understanding the Percentage Play

Whether it’s the gross profit margin or net profit margin, we talk in terms of percentages. For instance, a 30% gross profit margin means for every dollar of sales, there is 30 cents of gross profit, before other business expenses are paid. A higher percentage indicates a good margin, suggesting that the company is efficient in managing production and sales costs to yield a healthy profit margin. In contrast, a 45% gross profit margin signifies that nearly half of the total revenue is gross profit. Determining what defines a good profit margin can vary depending on the industry and the individual business’s financial goals.

The profit margin formula is quite simple: (Sales - Cost) / Sales. By dividing the difference between the sales and costs by the net sales, you get the profit margin percentage. This crucial measure is now effortless to calculate with Business Calculator +.